Human-centered Capital : Accountability, Accessibility, and Transparency in Financial Frameworks

Nataly @ stock.adobe.com

The scenario Human-centered Capital highlights innovative solutions surrounding the impact of novel economic practices based on the introduction of the Internet and other protocols such as the Blockchain.

According to the Global Findex Database 2017, released by the World Bank in 2018, 31.5% of the world population was unbanked, with that figure rising to 35% in Europe and Central Asia. By considering such a scenario, public and private enterprises can build alternative financial systems accessible to these people.

The Ghanaian government introduced a Single e-Payment Platform, working as the central channel for citizens to pay their taxes and other state financial obligations. The platform called Ghana.GOV provides a point of access to all governmental services, ensuring to all citizens the ability to perform official payments through one single portal. Also, the alternative model called Open Payment API poses another possibility of using open-source APIs for the development and update of payment channels, enabling account aggregation through a mobile banking app.

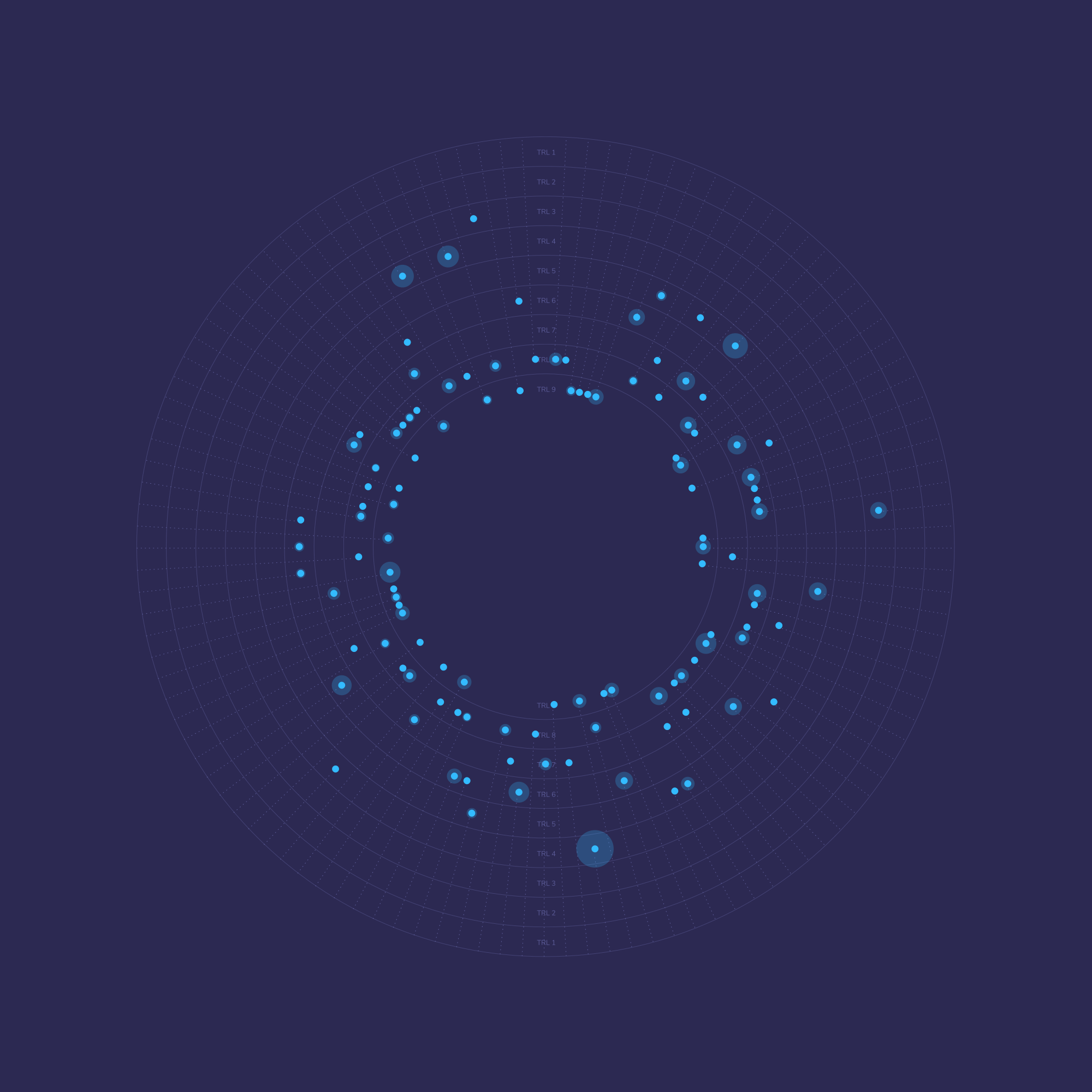

Previous examples relied on established economic strategies, whereas the implementation of digital currencies, cryptocurrencies, and blockchain-based systems seek to take a step further into the future. In the case of Blockchain-based Chama, the use of distributed ledgers to ensure accountability and transparency allows more individuals to take part in an initiative that can extend financial assistance to economically vulnerable groups. As for the concept of Sovereign Cryptocurrency, users can actively participate in the blockchain ledger, promoting long-term economic aid through an algorithmically fixed annual rate that allows individuals to validate their transactions automatically. These solutions show that, with the help of blockchain, both private and public banks and financial institutions, such as the case of the Republic of the Marshall Islands’ SOV Foundation, are tackling the technological and structural challenges of making the financial system more transparent and sustainable.

When it comes to fairness, more dynamic and adaptive solutions can take accountability and traceability to another level. With the creation of an economic framework that takes into consideration the environment, such as Biobased Economy, factories can be better monitored and accounted for the pollution they generate through the application of environmental taxes. In Sweden, the NOx environmental tax is a great example of an initiative introduced to tax the amount of nitrogen released into the environment to help increase efficiency on energy generation and reduce environmental impact. The same goes for the concept of Dynamic Redistributive Tax, which works as a real-time taxation system able to adapt taxes based on citizens’ updated financial conditions. Such a strategy, combined with initiatives such as Equitable Dynamic Pricing, can mitigate income inequality by taking advantage of technological tools to improve taxation and revaluation of the economic system in fluctuating market conditions and ongoing crises.

The aforementioned solutions increment value to the implementation of e-governments, all based on sustainability and transparency. The digital gap in terms of access to the Internet is still a key challenge to be surpassed in the years to come. Still, the relevancy of these technological tools posits unprecedented alternatives to transform ongoing bureaucratic procedures that tend to limit the interaction between citizens and governments.