Blockchain

Guilherme Henrique @ Envisioning

Broadly speaking, blockchain is a type of public ledger that can make nearly tamper-proof digital records. Its is a form of calculating trust. A set of data of common interest, called blocks, is validated and updated in real time after the conclusion of multilateral agreements with different nodes that run the software in a decentralized (peer-to-peer) network. The most recurrent way to explain the technology invented by a mysterious entity called Satoshi Nakamoto is through applications for financial data.

To be rewarded, the value-maximizing actors of a cryptocurrency notary system need to 'mine' the digital coins through a protocol called 'proof of work', which is nothing more than an evidence that the miner spent a lot of computational effort to perform a task that, in this case, is to solve a complex mathematical puzzle. But there is a bit of a bummer. To that 'hashing function' link the blocks a lot of energy is demanded. A lot, really.

By analogy, mining is gambling, and to know how it works, consider the entire process as if it were a lottery, with each kilowatt-hour being a ticket. But rather than randomness, the rewards are the result of brute force. Solved puzzles, withdrawn prizes (read: bitcoins). Over time, puzzles become more complex, which requires more computational power and more energy consumption. Today it is estimated that the annual carbon footprint of cryptocurrencies financial system is equivalent to that of Argentina. This needs to be regulated. Or force mining farms to buy Blockchain-based Carbon Credits, binding the cost ceiling for electricity consumption.

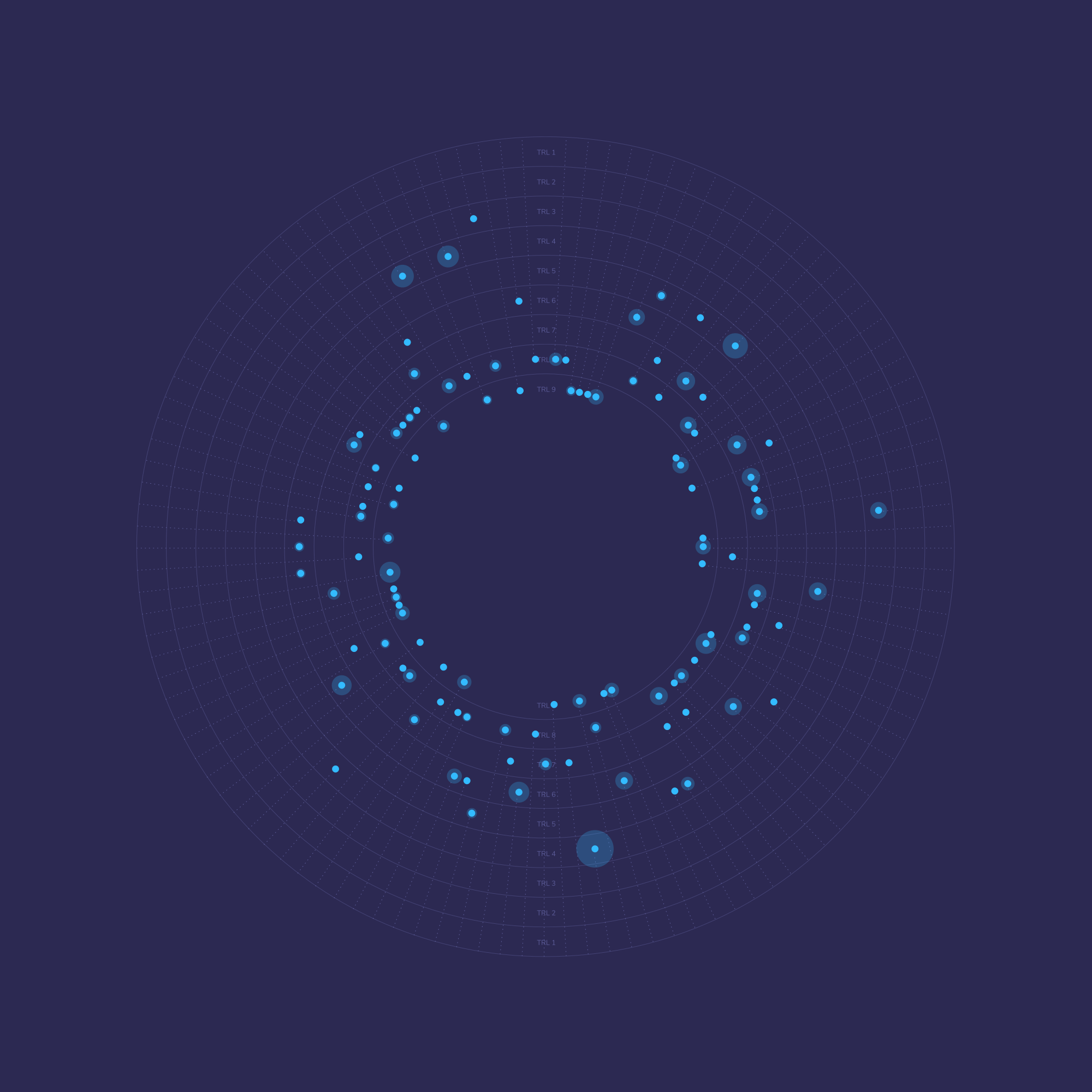

Bitcoin Electricity Consumption

Yasmim Seadi @ © Envisioning

Bitcoin Electricity Consumption

Yasmim Seadi @ © Envisioning

Cryptoart

Unlike the fungible bitcoins, interchangeable by definition, a non-fungible token, or a NFT, is a thing —and for a thing, you can imagine anything, like Minecraft pickaxes, pop songs, smart contracts, art works— a unique and exclusive thing, not liable in principle to mechanical reproduction. The cool mania now is hunting pieces of cryptoart that, after obtaining metadata of creator, date, owner, and so on, are logged on the blockchain of a cryptocurrency called Ethereum (the second most popular, after Bitcoin).

Art and marketplace are more connected than ever —especially in times of globalization. The art crowd excitement over new technologies is more visible than ever, turning up dark facets, like the upsurge of price speculation. To test this hypothesis, look at the recent purchase of a Bansky —in itself, a name that exudes speculation— by a group of digital art enthusiasts, who after tokenizing it into NFT, ritualistically burned the work in order to pump up its value.

There is too much at stake. After decades fighting to assert itself as a major player in the art world, it seems that network-based art, an original form of distributed and fungible new media art, is walking towards its twilight. NFT art represents a returning back to the artwork as an object, an owned fetish. Instead of participatory creative power scattered across servers, simple single-file art solutions are now bestowed on us.

Blockchain Chicken Farm

China has notoriously bad food safety. Yet, blockchain food projects along with Rural Revitalization, an official strategy that promotes steady agricultural development, is helping to revert the situation and increase the level of societal trust. Typical upper-class urbanites are willing to pay a premium on food, as for example free-range chickens. Enter blockchain, the trendy technology known for its ability to address tracking and commodity provenance. Just like a chicken Fitbit, an ankle bracelet tracks the number of steps that the poultry has taken, ensuring it lives in the green mountains of Guizhou and hasn't left a certain area.

The raising of surveilled chickens is just one example of what can be done with blockchain technology. Since food-safety inspection records in China are subject to falsification, it makes sense to have a technical infrastructure that can mediate trust automagically on the margins of the government power. But at some point, you have to trust some real person, as those who write the code. Thus, the mantra of developers should be the strengthening of decentralization and the empowerment of citizens, in the way of a blockchain sharing economy.

What Lies Ahead

Homo economicus

The empowerment of the people does not mean the cancellation of the State and its attributions. The vision of change that blockchain technology is trying to convey has to do with cutting red tape, whether or not a shared responsibility is added along the way. Everybody is talking about DeFi ecosystems, an experimental form of finance inspired by blockchain. But what is really on the horizon is the digital fiat currency, like the central bank digital currency (CBDC), in which agents no longer rely on intermediaries such as clearing houses to carry out transactions. China, not surprisingly, has become the forerunner in developing a digital version of the yuan, what is not exactly a standard cryptocurrency. The difference is that this digital legal tender will be firmly controlled by China's government. But before criticizing authoritarianism, take into account that Bitcoin, being largely out of control, ends up aggravating problems of financial engineering, money-laundering and fraud.

Homo energeticus

In a distributed energy future people are not only energy consumers, they can also produce it, like the mixotrophs, plankton that yield and absorb their own energy. Consider a future where smart grids join together to home energy management (HEM) systems, merging an integrated autonomous energy grid where people are in charge of micro-generation dynamic pricing. A blockchain network and its applications can therefore manage corresponding transactions, as created and sold electricity, and purchased and consumed tokens. It is not up to the user to play the role of her utility provider as the State has the ultimate responsibility. What is expected is that a well adjusted blockchain network can offers agents lower-carbon ways of life.

Methods

It is possible to track the movement of goods from raw materials to the end consumer (and even in circular economies) and keep reliable digital records of an asset's origin, characteristics, and ownership. For this to take place, a smart contract is deployed to a local hyperledger fabric network via a blockchain platform. As the asset is moving along the supply chain, it is scanned via RFID or barcode by IoT devices, which publishes an event notification to the blockchain platform. The platform then notifies all applications involved in the process that the scan has taken place. An application listening to the platform then invokes a transfer action, which automatically updates the asset's location in the ledger.

An alternative consensus algorithm to the Proof of Work (PoW) model. Proof of Stake relies on market incentives instead of computing power to verify transactions, thus reducing energy consumption. In this implementation of blockchain technology, participants build trust by putting down a deposit or stake amount of cryptocurrency in exchange for the right to add blocks to the distributed ledger. In the Proof of Stake model, there are no miners but validators who mint or forge new blocks.

An enhancement of the Double-Entry bookkeeping method where a transaction is recorded in three locations: the buyer's book, the seller's book, and a cryptographically secure third book in the blockchain, which is immutable and distributed. This data security method reduces fraud by adding more identification layers, and its objective is to improve accounting procedures.

A permissionless consensus mechanism that relies on computing power to verify transactions occurring in the Blockchain. The purpose of this mechanism is to ensure immutability and unhackability by hindering the manipulation of data recorded in the distributed public ledger through mathematical puzzles established over large energy and specific hardware conditions. In this method, miners are constantly competing to append blocks and mint new currency, in which their success is proportional to computing power expended.